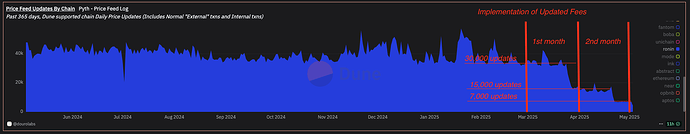

Below data is as of end of March, 2025, sourced from this Dune Dashboard and internal data. Shown below are the monthly averages of price updates per chains. You can find the table here.

Abstract → no change

Abstract launched earlier this year, and Pyth activity remains limited—averaging around 200 price updates per day. Given the low usage, I recommend holding off on fee implementation for now. Waiting for a clearer usage pattern will allow us to set a more appropriate price for the oracle service.

Apechain —> no change

Apechain, which launched in late 2024, has shown inconsistent Pyth usage that is currently trending downward. As with Abstract, I recommend waiting before introducing fees. A more stable usage baseline will make it easier to calibrate an appropriate pricing model.

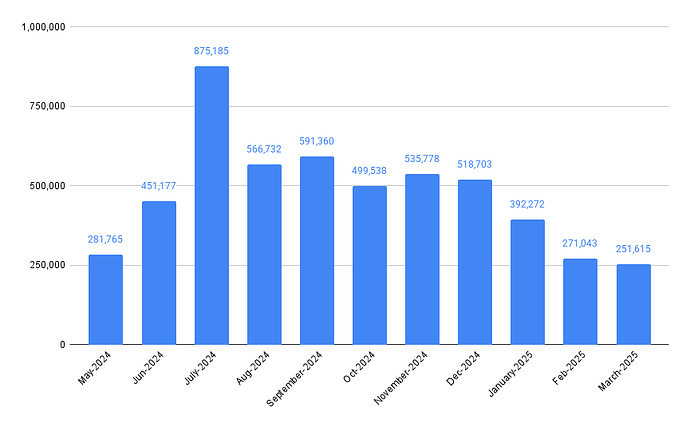

Arbitrum —> 0.000003 ETH / price update

Pyth usage on Arbitrum has ranged between 250,000 and 1,000,000 updates per month (roughly 8,000 to 33,000 per day). Arbitrum is a mature ecosystem where transaction costs are meaningful (typically a few cents), making it a suitable candidate for modest fee introduction.

Looking deeper into usage:

Since fees are charged per feed update (not per contract interaction), the most impacted user would be 0x63e89B…0Dbb. They currently pay around $0.04 in gas per transaction (~360 txs/day = $15/day or $450/month). Charging $0.005 per feed update would triple their total cost—but the protocol can optimize update frequency based on actual price deviations.

Given these dynamics, a fee of 0.000003 ETH per update (~$0.005) feels fair and sustainable.

Aurora → 0.000006 ETH / price update

Pyth usage on Aurora has held steady at around 1,000 updates per day. Aurora was one of the first 8 chains to adopt a fee of 0.000003 ETH (~$0.005), and usage remained stable after the change.

Given this, I recommend increasing the fee to 0.000006 ETH per update (~$0.01).

Avalanche → 0.0005 AVAX / price update

Avalanche has seen between 2,000 and 8,000 updates per month recently. Like Aurora, it was part of the initial 8-chain fee rollout at 0.00025 AVAX (~$0.005). Usage has continued unaffected.

Following the same logic as Aurora, I recommend increasing the fee to 0.0005 AVAX per update (~$0.01).

Base → 0.000003 ETH / price update

Pyth monthly usage on Base has ranged from 250,000 to 600,000 updates recently. Like Arbitrum, Base is a relatively mature ecosystem with non-trivial transaction costs (a few cents). Based on this, I would recommend applying non-zero fees on Base.

Looking more closely at onchain usage:

A fee of $0.005 per feed (0.000003 ETH) would approximately double most users’ costs—still reasonable for the scale and usage patterns observed.

Berachain —> no change

Berachain, launched early 2025, is showing significant growth in Pyth activity. However, nearly all updates (99%) originate from a single scheduler: 0x9F60…. Given the ecosystem is still early and usage is highly concentrated, I would not recommend implementing any fees for now. Better to wait for usage to consolidate further.

Bittensor —> no change

Bittensor (EVM) remains in a test-level phase for Pyth usage. I would recommend holding off on implementing any fees until there’s more consistent and organic activity.

Blast —> 0.000006 ETH / price update

Blast has shown increasing Pyth usage, ranging from 25,000 to 200,000 monthly updates. Like Arbitrum and Base, it’s a mature ecosystem with meaningful tx costs. I recommend applying non-zero fees.

Key users:

- 0x874C… runs a scheduler updating 2 feeds every 10 min—txs cost ~$0.02.

- 0x6a53… updates 1 feed per minute—also around $0.02 per tx.

Charging $0.01 per feed would double their cost, which feels appropriate and not overly burdensome.

BNB Chain → 0.0000333 BNB / price update

BNB Chain usage has scaled rapidly, growing from 200 to over 2,000 daily updates. As with Arbitrum and Base, it’s a sticky chain with expensive transactions. I recommend introducing a $0.02 fee per feed update.

Notable actors:

- 0x2f02… updates 8 feeds a few times daily; each tx costs ~$0.20.

- 0x1b6F… (APX) updates one feed on each trade—often multiple times per minute—with txs exceeding $0.50.

- 0x5A33… and 0xD7fe… likely keepers from derivatives protocols, showing similar behavior.

$0.02 per update should remain sustainable for these users.

Boba —> 0.000006 ETH / price update

Boba has seen recent uptick in usage, now averaging 100–150 daily updates—up from ~100 total in March. With onchain updates costing ~$0.01 per tx, a $0.01 update fee would double usage costs (from ~$1 to ~$2/day), which remains acceptable.

BTTC → 16,000 BTT / price update

Though Pyth has been deployed on BTTC for over a year, usage remains very low. Given the overall ecosystem activity is also minimal, I recommend applying a baseline $0.01 fee.

Canto → 1 CANTO / price update

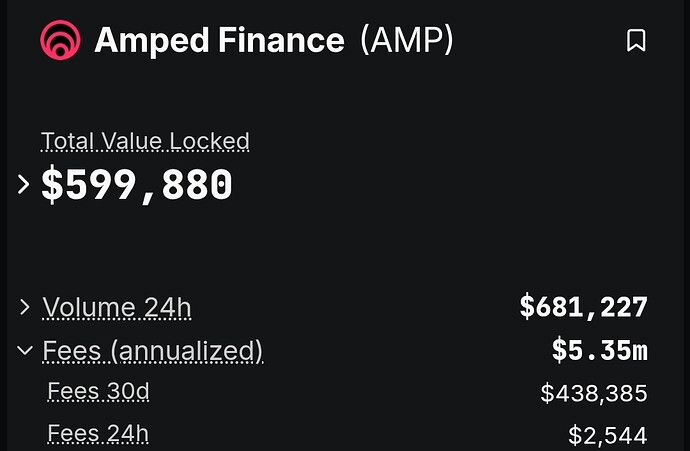

The Pyth oracle on Canto has seen little activity recently, with the last price update occurring in September 2024. Additionally, DeFi activity on Canto is at an all-time low, as reflected by Defillama. Given these factors, I recommend setting a fee of $0.01 for Pyth updates on Canto.

Celo → 0.000006 ETH / price update

Pyth usage on Celo has remained steady, with around 2,000–5,000 updates per month (66–166 daily updates). Celo has undergone significant changes, transitioning from an L1 to an OP L2, with low transaction costs. Given this steady usage, I propose applying a small fee on Celo.

Upon reviewing on-chain activity, it’s clear that most of the usage originates from a single contract:

- Contract updates 3 feeds per trade. Each update typically costs $0.005, which means this user spends around $10 monthly on Pyth.

Charging $0.01 per feed update would increase their costs but remain reasonable, given the current expenditure.

Chiliz → 0.03 CHZ / price update

Pyth was deployed on Chiliz a year ago, but usage has been minimal. DeFi activity in the Chiliz ecosystem remains low, as seen on Defillama. I suggest implementing a $0.01 fee for Pyth updates on Chiliz.

Conflux → no change

Pyth usage on Conflux has fluctuated significantly, from a few thousand updates per month to several thousand per day, and back again. Fees were increased in February to 0.01 CFX ($0.006), and since then, 260 CFX have been collected by the Pyth contract. Despite the change, user behavior has adapted, with fewer updates occurring.

Given this, I recommend maintaining the current fee structure on Conflux and monitoring usage over the coming months for further trends.

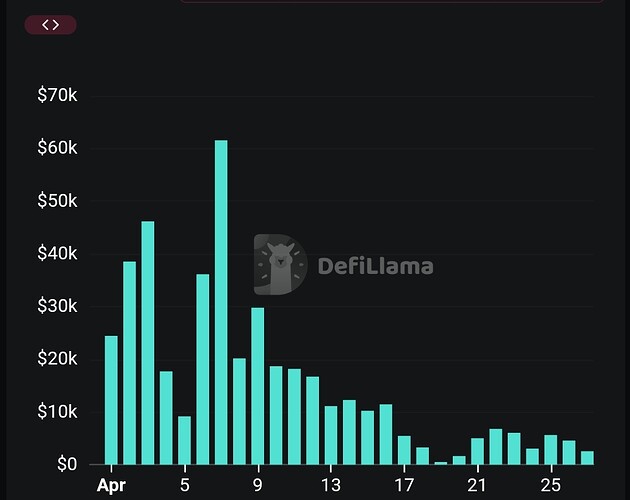

CoreDAO → 0.0025 CORE

Over the past year, Pyth usage on Core has grown consistently, from 25,000 daily updates to nearly 70,000. Core’s DeFi ecosystem has also seen substantial growth, with TVL increasing from a few million to nearly half a billion, as shown on Defillama. Given the rising demand, I recommend introducing a non-zero fee on Core.

On-chain activity shows two major users:

- User 1 updates 7 feeds every 30 seconds, with each transaction costing about $0.01.

- User 2 exhibits similar behavior.

Extrapolating from this usage, we estimate around 2,000,000 feeds updated per month, costing about $3,000 monthly. A fee of $0.0015 per update would double these users’ costs, potentially leading them to reduce update frequency.

Cronos → no change

Although Cronos was among the first chains to have their fees increased in February, usage has remained at an all-time high. The current fee of 0.06 CRO ($0.005) has resulted in the Pyth oracle collecting over 12,000 CRO ($1,000).

While the data is promising, I recommend maintaining the current fee structure on Cronos for now, as more data is needed to confirm whether this growth will continue.

Cronos zkEVM → 0.6 CRO

Pyth usage on Cronos zkEVM has been steady and significant in recent months. Given that Cronos zkEVM is part of the broader Crypto.com ecosystem, which has shown resilience, and that transaction costs are non-trivial, I recommend implementing a small fee on Pyth updates.

One protocol is responsible for the majority of price updates:

- Protocol updates 22 feeds every 15 minutes, with each transaction costing about $0.06.

Given the usage patterns, I propose a fee of $0.005 per updated feed, which aligns with the fee on the original Cronos chain.

EOS → 0.16 EOS

Pyth usage on EOS has remained steady, with daily price updates ranging between 35 and 100. The EOS EVM ecosystem has yet to gain significant traction since its launch — Defillama.

When analyzing onchain usage, we can see that one contract handles the majority of the price updates:

The total monthly cost for this user is about $110, which remains inexpensive. Therefore, I suggest a charge of $0.1 per feed update on EOS — this would still only double the user’s incurred costs.

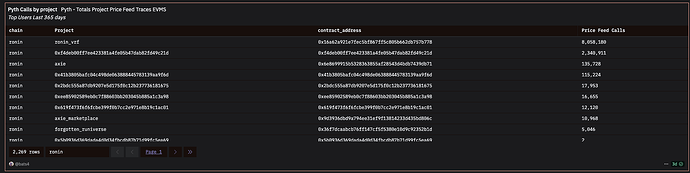

EVMOS → 3 EVMOS / price update

For almost six months, no price updates have been triggered on the Pyth oracle on the EVMOS mainnet — contract. Additionally, the EVMOS ecosystem has experienced minimal activity. Given this, I recommend setting the Pyth oracle fee at $0.01 per update.

Ethereum → 0.00001 ETH / price update

Over recent months, Pyth oracle usage on Ethereum mainnet has grown, with daily updates ranging from 200-250 price feeds. Considering the relatively high cost of Ethereum transactions, applying non-zero fees would be noticeable by end users.

Examining onchain usage, we find the following:

Given these costs, I would recommend a fee range of $0.01–$0.02 per price update on Ethereum mainnet. This would be minimal for end users while ensuring sustainable Pyth usage on Ethereum, the chain with the highest TVL.

Etherlink → 0.01 XTZ / price update

Etherlink has seen stable Pyth usage with 6,500-10,000 daily updates. Etherlink’s low transaction costs (under $0.01) have helped boost these numbers. Additionally, the Etherlink ecosystem has experienced rapid growth in recent months — Defillama.

Most usage comes from:

With an estimated 300,000 updates monthly, the user spends around $450. I recommend charging $0.005 (0.01 XTZ) per feed, which would multiply their cost by 4-5 times.

Eventum → 0.000006 ETH / price update

Eventum (the app layer for EVEDEX) saw slow Pyth usage after deployment but has since experienced steady growth. Transaction fees on the base layer remain low, suggesting room for small fees. I recommend $0.01 per feed updated.

Onchain usage shows:

A $0.01 fee would increase the user’s costs by 50%, staying under $500 monthly.

Fantom → 0.02 FTM / price update

Fantom, now transitioning to Sonic (S), remains in “maintenance mode.” As usage migrates to the new chain, Pyth usage on Fantom is expected to gradually decline. Given the situation, I recommend establishing a baseline fee of $0.01 per feed updated.

Filecoin → 0.004 FIL

The Pyth oracle on Filecoin EVM has seen limited but recent usage. The ecosystem is dominated by liquid staking protocols, with minimal activity elsewhere. Transactions remain inexpensive, with costs around $0.005. The user in question updates 1 feed sporadically. Given these numbers, I suggest charging $0.01 per feed updated.

Flow → 0.03 FLOW / price update

Flow has seen an increase in both Pyth usage and ecosystem growth, with 800-900 price updates triggered daily. With its low transaction costs and increasing TVL, I recommend applying non-zero fees for Flow.

One user drives most of the updates:

The total cost for the user is around $1 per month. I recommend charging $0.01 per feed update, which would increase their cost to approximately $250 monthly.

Gnosis → 0.01 XDAI / price update

Pyth usage on Gnosis has been significant, but with the protocol now shut down (no recent updates), usage has declined to near zero. However, the Gnosis ecosystem remains active and growing, with low transaction costs (below $0.001). As a result, I suggest charging $0.01 per feed update as a baseline.

Gravity → 0.5 G / price update

Gravity has seen relatively slow growth since its launch, with transaction costs under $0.01. The price update volume on Pyth is fairly high, making it important to consider this for pricing.

Most of the updates come from:

Given the user’s 250,000 monthly updates, I recommend charging 0.5 G per feed, which would multiply their cost by 5. Reducing the polling frequency to 5 minutes could offset this cost increase though.

Hedera → 0.07 HBAR / price update

Pyth usage on Hedera has been stable but ceased a month ago. With the ecosystem showing steady TVL, I recommend charging a baseline fee of $0.01 per feed updated, in case usage resumes.

Hemi → no change

Hemi, with steady ecosystem growth, has seen no Pyth usage yet. I suggest charging $0.01 per feed update when activity begins.

Horizen EON → 0.001 ZEN / price update

Pyth usage on Horizen EON was steady but has tapered off due to one protocol’s shutdown. As with other ecosystems, I recommend charging $0.01 per feed updated to support future use.

HyperEVM → no change

HyperEVM has seen significant DeFi growth, but the usage of Pyth feeds remains concentrated in Sponsored Updates for money-market and CDP protocols. Given the current usage, I recommend refraining from implementing fees at this time.

Injective inEVM → 0.00125 INJ / price update

The Pyth oracle was deployed on Injective inEVM a year ago but has yet to see any usage. It’s important to highlight that the Injective inEVM ecosystem has struggled to gain significant traction, which explains the lack of activity on the oracle.

Given this, I recommend setting the baseline fee at $0.01 per price update, similar to other ecosystems, to ensure sustainability and incentivize potential future usage.

Ink → no change

Ink, an OP Superchain recently launched, has been slow to attract TVL and DeFi activity, similar to Abstract. Most of the Pyth activity on Ink stems from Pyth Sponsored Feeds — docs — which update 7 price feeds either every hour or upon a 1% price deviation.

As the network matures and more users adopt the platform, I recommend postponing the implementation of any fees on Ink for now. This approach will allow for better alignment of fees with user behavior and demand in the future.

IOTA EVM → 0.03 IOTA / price update

The Pyth oracle has been a key data source within the IOTA EVM DeFi ecosystem for several months. IOTA is known for its extremely low transaction costs, with most transactions under $0.0005.

Looking at the Pyth contract balance on IOTA, we estimate around 15,000 price updates daily. Two main addresses are responsible for the majority of updates:

With about 2,000 transactions per day, these users currently spend around $1 daily to update the oracle. Based on this usage, I recommend charging 0.005$ per price update. This adjustment would increase the daily cost to approximately $80, which may lead to a slight reduction in update frequency as users adapt to the new pricing.

Kaia → 0.05 KAIA / price update

Kaia is a long-established ecosystem that found new momentum in late 2024, which aligns with an increase in Pyth usage! In recent months, Pyth has seen between 3,500 and 6,500 daily price updates triggered on Kaia.

Kaia is a low-cost chain, with most transactions priced at around $0.003, meaning the protocol currently spends about $15 per day for these updates.

Given this, I recommend setting the fee at 0.005$ per price update, as this would only double the user’s cost, which seems fair considering the scale of usage.

Kava → 0.025 KAVA / price update

Pyth usage on Kava has steadily grown over the past few months, now averaging between 2,000 and 3,500 daily price updates. The Kava ecosystem has remained relatively stable, which is particularly notable given the challenging market environment over the past year.

Based on on-chain activity, we see that:

Given this usage pattern, I recommend a fee of 0.01$ per price update. This would increase the user’s daily oracle cost from under $1 to around $25-$30, which is a reasonable adjustment.

KCC → 0.001 KCS / price update

Pyth’s deployment on KCC is one of the earliest, and usage remained steady until mid-March. Since then, there have been no recorded price updates on-chain. KCC itself has seen limited traction, with a declining TVL. However, given the history of cyclical usage, I recommend establishing a baseline fee of $0.01 per update, in case usage picks up again.